Explore Eastern Europe

Estonia

Digital-first EU jurisdiction with e-Residency program and 0% tax on retained profits

Albania

Albania is a Southeast European nation with competitive 15% corporate tax, EU candidate status, and a growing economy offering opportunities for cost-effective business operations.

Hungary

EU member with Europe's lowest corporate tax at 9%

Croatia

EU and Eurozone member with competitive tax rates

Explore Central America

Nicaragua

Nicaragua is a Central American nation with no minimum capital requirements, free trade zone incentives, and low operational costs, though international sanctions affect some business activities.

Honduras

Honduras is a Central American nation with CAFTA-DR trade benefits, free trade zone incentives, and growing manufacturing sector, particularly in textiles and apparel.

Guatemala

Guatemala is Central America's largest economy with low personal income tax (7%), low minimum capital requirements, and access to CAFTA-DR trade benefits.

Costa Rica

Stable Central American democracy with territorial taxation

Explore Middle East

United Arab Emirates (Dubai)

Tax-free zones with global connectivity

Turkey

Bridge between Europe and Asia with large market

Jordan

United Arab Emirates

The UAE is a premier business hub in the Middle East offering free zones with 0% corporate tax, world-class infrastructure, and excellent banking access.

Explore Oceania

Vanuatu

Pacific tax haven with citizenship by investment program

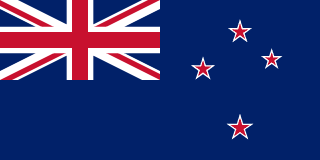

New Zealand

Business-friendly jurisdiction with no capital gains tax

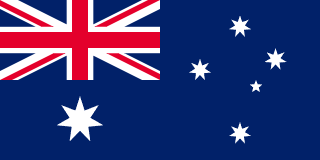

Australia

Asia-Pacific hub with common law and stable economy

Nauru

Nauru is a small Pacific island nation with a 30% corporate tax rate that introduced income taxation in 2014 after decades as a tax haven.

Welcome to StateBay

Articles and news will appear here once they are published. In the meantime, explore our jurisdiction comparison tools.

Explore Jurisdictions