Explore Countries for Living & Doing Business

Find and compare the best jurisdictions for your business

Find and compare the best jurisdictions for your business

Compare with other jurisdictions or get in touch for expert guidance.

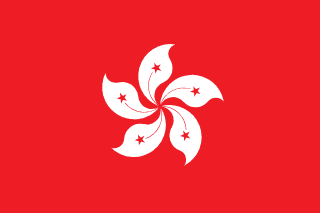

Gateway to Asia with territorial taxation system

Region

ASIA PACIFIC

Corporate Tax

16.5%

Setup Time

1 weeks

Currency

HKD

Hong Kong, a Special Administrative Region of China, has served as Asia's premier financial center. The territory's efficient company registration and established legal framework continue to support business setup, though political changes require consideration.

With a population of 7.5 million in dense urban environment, Hong Kong offers intense cosmopolitan living. Chinese and English are official languages, with Cantonese predominant. The subtropical climate is humid with distinct seasons.

Healthcare is excellent through public and private systems. Safety has been very good historically. The cost of living is extremely high, particularly housing, which is among the world's most expensive.

The dynamic business culture, dining, and East-meets-West character define the territory.

Corporate tax applies at 16.5% (8.25% on first HKD 2 million). Personal tax is capped at 15%. No VAT, capital gains tax, or withholding tax on dividends applies. The territorial tax system means foreign-sourced income is generally not taxed.

The Hong Kong dollar is pegged to the US dollar. The financial services sector remains substantial despite recent challenges. The legal system remains based on common law.

Company registration through the Companies Registry is highly efficient. Private limited companies are the standard vehicle. Foreign ownership faces no restrictions for most activities.

Company formation completes within days, sometimes hours. Minimum capital is HKD 1. At least one director and one shareholder required, who may be the same. Annual compliance includes audited accounts and returns.

The Securities and Futures Commission has implemented licensing for virtual asset trading platforms. Hong Kong has developed a crypto license framework seeking to establish the territory as a regulated digital asset hub.

The approach provides regulatory clarity for substantial operations meeting compliance standards.

Gambling is prohibited in Hong Kong except for the Hong Kong Jockey Club's regulated activities. No gambling license opportunities exist for commercial operators.

Political changes since 2019-2020 have affected the territory's international perception and some business operations. The National Security Law has created new compliance considerations. The relationship with mainland China is both opportunity and complexity.

Banking access remains excellent through major international banks. Professional services are world-class. Hong Kong retains substantial infrastructure advantages despite challenges.

Hong Kong suits Asia-Pacific regional operations, trading companies, and businesses comfortable with current political environment for their business setup.

Local: Ltd

Local: Ltd

Local: LP

Local: Branch

| Corporate Tax Rate | 16.5% |

| Personal Income Tax Rate | 16% |

| VAT / Sales Tax | 0% |

| Capital Gains Tax | 0% |

| Withholding Tax | 0% |

| Reduced Corporate Tax Available | Yes |

| Non-Resident Withholding Exempt | Yes |

| Tax Treaty Network | Yes |

| Banking Access | EXCELLENT |

| Financial Privacy | MEDIUM |

| Currency Controls | NONE |

| Local Bank Account Required | No |

| Non-Resident Bank Account Allowed | Yes |

| Physical Presence for Banking | Yes |

| Banks Restrictive (High Risk) | No |

| AML Officer Required | No |

| MLRO Required | No |

| Compliance Officer Required | No |

| Data Protection Officer Required | No |

| Bookkeeping Frequency | Annual |

| Local Bookkeeping Required | No |

| Mandatory Audit | Yes |

| License Required | Yes |

| Local Director Required | No |

| Local AML Director Required | No |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Required Share Capital | $5,000,000 |

| Capital Maintained in Account | Yes |

| Compliance Program Required | Yes |

| Travel Rule Compliance | FATF Travel Rule - HKD 8,000 threshold for enhanced information requirements |

| Business Plan Required | Comprehensive 2-year business plan with financial projections, service descriptions, operational workflows, and target client segments required |

| Personnel Required | Minimum 2 Responsible Officers (ROs) who pass SFC fit and proper test, one must be Executive Director; Licensed Representatives for client-facing roles |

| Insurance Required | Yes |

| Insurance Details | Insurance or equivalent risk mitigation for client assets required; specific requirements determined by SFC |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 1 |

| Shareholder/Director Same Person | Yes |

| Registry Public | Yes |

| Registry Access | SFC public register of licensed VATPs at www.sfc.hk |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | Yes |

| Technical Audit Mandatory | Yes |

| Corporate Income Tax Applicable | Yes |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | Yes |

| VAT Applicable | No |

| Regulators | Securities and Futures Commission (SFC) for VASP/VATP license; Hong Kong Monetary Authority (HKMA) for stablecoin issuers |

| Licensing Fee | $0 |

| Licensing Fee Details | Application fees waived for initial VASP applications; annual fees based on regulated activities; external assessment costs (by licensed CPA) typically HKD 500,000-2,000,000 |

| Permitted Business Models | Virtual Asset Trading Platforms (VATPs), Custody Services (licensing pending 2026), OTC Dealing Services (licensing pending 2026), Stablecoin Issuers (from August 2025) |

| Permitted Activities | Spot trading, custody, staking services (with SFC pre-approval), trading of SFC-approved tokens |

| Restricted Activities | Privacy coins not generally approved for listing; retail access subject to investor protection controls including knowledge tests and risk profiling |

| Cross-Border Service Allowed | No |

| Physical Inspection Required | Yes |

| Derivatives Allowed | Yes |

| RWA Tokenization Allowed | Yes |

| App Store Listing Allowed | Yes |

| Crypto Custody Allowed | Yes |

| License Required | Yes |

| Local Director Required | No |

| Local AML Director Required | No |

| Local Legal Address Required | No |

| Local Physical Office Required | No |

| Required Share Capital | $0 |

| Capital Maintained in Account | No |

| Compliance Program Required | No |

| Travel Rule Compliance | N/A |

| Business Plan Required | N/A - No commercial gambling licenses available |

| Personnel Required | N/A |

| Insurance Required | No |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | No |

| Min. Shareholders | 0 |

| Min. Directors | 0 |

| Shareholder/Director Same Person | No |

| Registry Public | No |

| Registry Access | N/A |

| Renewal Period | N/A |

| Accounting Filing Required | No |

| Accounting Filing Frequency | N/A |

| Financial Statement Required | No |

| Financial Statement Frequency | N/A |

| Accounting Audit Mandatory | No |

| Compliance Audit Mandatory | No |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | No |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | No |

| VAT Applicable | No |

| Regulators | Home Affairs Department (for limited amusement licenses); Hong Kong Jockey Club holds exclusive monopoly on authorized gambling |

| Licensing Fee | $0 |

| Licensing Fee Details | Commercial gambling licenses NOT AVAILABLE to private operators. Only Hong Kong Jockey Club is authorized to operate horse racing betting, football betting, and Mark Six lottery. Limited licenses available for amusement game centers, mahjong parlors, and charitable lotteries only. |

| Permitted Business Models | N/A for commercial operators - HKJC monopoly only |

| Permitted Activities | Amusement game centers (licensed), charitable lotteries (licensed), mahjong/tin kau parlors (licensed) |

| Restricted Activities | All commercial gambling including casinos, sports betting (except HKJC), online gambling, bookmaking - strictly prohibited for private operators |

| Cross-Border Service Allowed | No |

| Physical Inspection Required | No |

| Player Fund Segregation | No |

| B2B/B2C Separate Requirements | No |

| License Required | Yes |

| Local Director Required | No |

| Local AML Director Required | No |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Required Share Capital | $5,000,000 |

| Capital Maintained in Account | Yes |

| Compliance Program Required | Yes |

| Travel Rule Compliance | FATF compliant - full AML/CFT program required under AMLO |

| Business Plan Required | Comprehensive business plan including 6-month operational budget forecast, organizational structure, risk management framework |

| Personnel Required | Minimum 2 Responsible Officers (ROs) for SFC Type 9; Managers-in-Charge (MICs) covering 8 core functions; all client-facing staff must be Licensed Representatives |

| Insurance Required | Yes |

| Insurance Details | Professional indemnity insurance required; specific coverage varies by license type and activities |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 1 |

| Shareholder/Director Same Person | Yes |

| Registry Public | Yes |

| Registry Access | SFC Register of Licensed Persons and Registered Institutions at www.sfc.hk; HKMA Register of SVF Licensees |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Monthly FRR returns for certain license types; Annual audited accounts |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | Yes |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | Yes |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | Yes |

| VAT Applicable | No |

| Regulators | Securities and Futures Commission (SFC) for Types 1-13 regulated activities; Hong Kong Monetary Authority (HKMA) for banking, SVF, stablecoins; Customs & Excise Department (C&ED) for Money Service Operators |

| Licensing Fee | $4,680 |

| Licensing Fee Details | SFC corporate license application fee: HKD 4,680; Individual license fees: HKD 1,560-3,900; MSO license: HKD 3,310 base + HKD 860 per fit and proper check; SVF license fees vary based on scale. Processing time: 15 weeks for SFC corporate applications. |

| Permitted Business Models | Type 1 (Dealing in Securities), Type 4 (Advising on Securities), Type 9 (Asset Management), Money Service Operators (remittance, currency exchange), Stored Value Facilities (e-wallets, prepaid cards) |

| Permitted Activities | Securities dealing, investment advisory, fund management, money changing, remittance services, payment services |

| Restricted Activities | Banking requires HKMA authorization with substantial capital requirements; margin financing subject to additional requirements |

| Cross-Border Service Allowed | Yes |

| Physical Inspection Required | Yes |