Explore Countries for Living & Doing Business

Find and compare the best jurisdictions for your business

Find and compare the best jurisdictions for your business

Compare with other jurisdictions or get in touch for expert guidance.

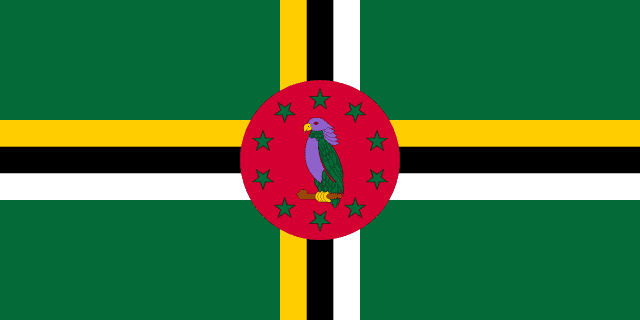

Caribbean island with affordable citizenship program

Region

CARIBBEAN

Corporate Tax

25%

Setup Time

2 weeks

Currency

XCD

Dominica, known as the "Nature Island of the Caribbean" for its pristine rainforests and natural hot springs, offers one of the most affordable Citizenship by Investment programs in the region. This mountainous island combines strong financial privacy laws with a cost-effective path to Caribbean citizenship.

With a population of approximately 72,000, Dominica offers an authentic Caribbean experience focused on eco-tourism and natural beauty. English is the official language, with French Creole widely spoken. The rugged volcanic terrain features dramatic landscapes including Boiling Lake, the second-largest hot spring in the world.

Healthcare services are provided through Princess Margaret Hospital in Roseau, with medical evacuations to larger regional centers for specialized care. The cost of living is lower than most Caribbean islands, making it attractive for budget-conscious expatriates. However, the mountainous terrain and limited beaches mean it attracts a different demographic than typical Caribbean destinations.

Dominica is geographically positioned between Martinique and Guadeloupe, with ferry connections to neighboring French islands. Hurricane Maria in 2017 caused significant damage, but the island has substantially rebuilt with improved infrastructure and climate-resilient construction.

International Business Companies (IBCs) previously enjoyed tax exemptions, but reforms in 2019-2021 eliminated these benefits. IBCs are now subject to 25-30% corporate tax on worldwide income if managed from Dominica. However, there is no capital gains tax and no inheritance tax.

The Eastern Caribbean Dollar (XCD), pegged to the US Dollar at 2.70:1, ensures currency stability. No exchange controls restrict capital movement. Dominica is a member of CARICOM, providing access to regional trade agreements.

Section 112 of the IBC Act provides exceptional confidentiality protections. Unauthorized disclosure of company information is a criminal offense carrying penalties of USD 25,000 and up to 2 years imprisonment.

IBCs can be incorporated within 24-48 hours through the Financial Services Unit. Key features include:

Annual requirements include maintaining a registered agent and paying government fees. Financial statements are not publicly filed.

Dominica has not established a formal VASP licensing framework. Digital asset businesses operate under general Financial Services Unit oversight. Notably, TRON tokens were granted statutory status as authorized digital currency effective October 7, 2022, making Dominica an early adopter of specific crypto recognition.

Entrepreneurs seeking formal crypto licensing may find the current environment uncertain, though general AML/CFT compliance with FSU guidance provides a basic framework for operations.

The FSU regulates online gambling under established legislation. License fees include EC $40,500 (USD 15,000) application fee and annual license fees of EC $202,500 (USD 75,000) flat or the greater of EC $135,000 (USD 50,000) or 5% of gross revenue.

Key requirements include USD 1.35 million share capital, 5-year business plan, and technical audits. Operators cannot serve Dominican citizens or residents. The framework covers online casino, sports betting, and 800-number betting operations.

Dominica's CBI program, established in 1993, is consistently ranked among the best in the world for value and due diligence standards. It offers two primary pathways:

Economic Diversification Fund (EDF): Starting at USD 100,000 for a single applicant, making it one of the most affordable CBI programs globally. Family applications available with USD 150,000 for a family of four.

Real Estate Investment: Minimum USD 200,000 in approved real estate projects, held for a minimum of 3 years (reduced from 5 years). This is the most competitive real estate threshold among Caribbean CBI programs.

Processing typically takes 3-4 months, among the fastest in the Caribbean. Enhanced due diligence is conducted by the Citizenship by Investment Unit with background checks through international agencies.

Dominica citizenship provides visa-free or visa-on-arrival access to over 140 countries, including the UK, EU Schengen area, Hong Kong, Singapore, and most Commonwealth nations. Citizens can live and work in any OECS member state.

The program focuses on economic development, with EDF contributions funding hurricane recovery, climate resilience, geothermal energy projects, and healthcare improvements. The government maintains strict integrity standards and has rejected numerous applications that fail due diligence.

Banking access can be challenging for IBCs and CBI citizens, with regional banks applying enhanced scrutiny. The lack of an international airport (requiring ferry or small plane connections via nearby islands) limits accessibility. Professional services are available but more limited than larger financial centers.

Dominica's mountainous terrain and limited flat land affect real estate options and infrastructure development. The island's focus on eco-tourism means entertainment and nightlife options are minimal compared to other Caribbean destinations.

The jurisdiction suits entrepreneurs seeking affordable citizenship options, those valuing strong privacy protections, eco-tourism investors, and individuals wanting Caribbean residency at lower cost points than neighboring islands.

Local: LLC

Local: IBC

Local: Foundation

| Corporate Tax Rate | 25% |

| Personal Income Tax Rate | 0-35% |

| VAT / Sales Tax | 15% |

| Capital Gains Tax | 0% |

| Withholding Tax | 15% |

| Reduced Corporate Tax Available | No |

| Non-Resident Withholding Exempt | No |

| Tax Treaty Network | Yes |

| Banking Access | MEDIUM |

| Financial Privacy | HIGH |

| Currency Controls | NONE |

| Local Bank Account Required | No |

| Non-Resident Bank Account Allowed | Yes |

| Physical Presence for Banking | No |

| Banks Restrictive (High Risk) | Yes |

| AML Officer Required | No |

| MLRO Required | No |

| Compliance Officer Required | No |

| Data Protection Officer Required | No |

| Bookkeeping Frequency | Annual |

| Local Bookkeeping Required | No |

| Mandatory Audit | No |