Explore Countries for Living & Doing Business

Find and compare the best jurisdictions for your business

Find and compare the best jurisdictions for your business

Compare with other jurisdictions or get in touch for expert guidance.

High-tech economy and global semiconductor leader

Region

ASIA PACIFIC

Corporate Tax

20%

Setup Time

2 weeks

Currency

TWD

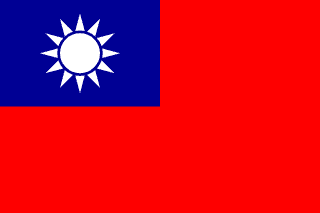

Taiwan, an island with disputed international status, offers world-leading semiconductor manufacturing and technology expertise. The company registration framework supports business setup in Asia's tech hardware hub.

With a population of 24 million, Taiwan offers modern living with Chinese cultural heritage. Mandarin Chinese is official, with English limited. The climate is subtropical to tropical.

Healthcare is excellent through National Health Insurance. Safety is outstanding with very low crime. The cost of living is moderate.

The food culture, temples, and natural landscapes create appealing lifestyle.

Corporate tax rate stands at 20%. Personal income tax reaches 40%. VAT applies at 5%.

The New Taiwan dollar is managed. Taiwan dominates global semiconductor manufacturing through TSMC. Electronics, technology, and precision manufacturing are highly developed.

Company registration through the Ministry of Economic Affairs is established. Limited companies require minimum capital. Foreign ownership is permitted in most sectors.

Company formation takes approximately 2-4 weeks. Minimum capital varies by activity. At least one director is required. Annual compliance includes tax and corporate filings.

Taiwan has developed regulatory approaches for virtual assets through the Financial Supervisory Commission. Registration and compliance requirements apply to exchanges and related businesses.

Gambling is largely illegal in Taiwan. No commercial gambling license opportunities exist.

International status creates specific considerations for certain activities. Cross-strait relations require awareness. The semiconductor focus creates both opportunities and concentration.

Banking access is available through Taiwanese banks. Professional services are well-developed for technology sector.

Taiwan suits technology companies, semiconductor supply chain, and manufacturing operations for their business setup.

Local: Ltd

Local: Co. Ltd

Local: Branch

| Corporate Tax Rate | 20% |

| Personal Income Tax Rate | 40% |

| VAT / Sales Tax | 5% |

| Capital Gains Tax | 20% |

| Withholding Tax | 21% |

| Reduced Corporate Tax Available | No |

| Non-Resident Withholding Exempt | No |

| Tax Treaty Network | Yes |

| Banking Access | MEDIUM |

| Financial Privacy | MEDIUM |

| Currency Controls | SOME |

| Local Bank Account Required | Yes |

| Non-Resident Bank Account Allowed | No |

| Physical Presence for Banking | Yes |

| Banks Restrictive (High Risk) | No |

| AML Officer Required | No |

| MLRO Required | No |

| Compliance Officer Required | No |

| Data Protection Officer Required | No |

| Bookkeeping Frequency | Annual |

| Local Bookkeeping Required | Yes |

| Mandatory Audit | No |

| License Required | Yes |

| Local Director Required | No |

| Local AML Director Required | Yes |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Required Share Capital | $0 |

| Capital Maintained in Account | No |

| Compliance Program Required | Yes |

| Travel Rule Compliance | FATF compliant requirements under development |

| Business Plan Required | Business plan required for FSC AML registration and upcoming VASP license |

| Personnel Required | AML Officer required; CEO and key management personnel subject to FSC review |

| Insurance Required | No |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 1 |

| Shareholder/Director Same Person | Yes |

| Registry Public | Yes |

| Registry Access | FSC maintains list of registered VASPs |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | No |

| Compliance Audit Mandatory | No |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | Yes |

| Dividend Tax Applicable | Yes |

| Capital Gains Tax Applicable | Yes |

| Territorial Tax Regime | No |

| VAT Applicable | Yes |

| Regulators | Financial Supervisory Commission (FSC) |

| Licensing Fee | $0 |

| Licensing Fee Details | Currently AML registration required (no fee specified). Full VASP license regime expected late 2025/early 2026 under Virtual Asset Services Act (VASA) - fees to be determined. |

| Permitted Business Models | Exchange, Custody, Wallet services, Token issuance platforms |

| Permitted Activities | Exchange between virtual assets and fiat currencies, exchange between virtual assets, transfer of virtual assets, custody and administration of virtual assets, participation in virtual asset issuance or sale |

| Restricted Activities | Security Token Offerings require separate FSC approval and must be conducted through licensed securities dealers |

| Cross-Border Service Allowed | No |

| Physical Inspection Required | No |

| Derivatives Allowed | No |

| RWA Tokenization Allowed | No |

| App Store Listing Allowed | Yes |

| Crypto Custody Allowed | Yes |

No private gambling licenses available. Gambling is prohibited except for state-run lotteries. Casino development was legalized for certain offshore islands (Kinmen, Matsu, Penghu) via 2009 referendum process, but no casinos have been built to date.

| License Required | Yes |

| Local Director Required | Yes |

| Local AML Director Required | Yes |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Required Share Capital | $500,000,000 |

| Capital Maintained in Account | Yes |

| Compliance Program Required | Yes |

| Travel Rule Compliance | FATF compliant |

| Business Plan Required | Comprehensive business plan required including operational structure, risk management, and financial projections |

| Personnel Required | Directors, managers, internal auditors must meet FSC qualification requirements; AML compliance officer required |

| Insurance Required | No |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 1 |

| Shareholder/Director Same Person | Yes |

| Registry Public | Yes |

| Registry Access | FSC Banking Bureau maintains public registry of licensed financial institutions |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | Yes |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | Yes |

| Dividend Tax Applicable | Yes |

| Capital Gains Tax Applicable | Yes |

| Territorial Tax Regime | No |

| VAT Applicable | No |

| Regulators | Financial Supervisory Commission (FSC) - Banking Bureau, Securities and Futures Bureau, Insurance Bureau |

| Licensing Fee Details | Varies by license type. Electronic Payment Institution (EPI) license requires NT$500,000,000 (approx. USD 15.6 million) minimum capital. Banking license requires NT$10 billion minimum paid-in capital. |

| Permitted Business Models | Electronic Payment Institution, Third-party Payment Provider, Securities Firm, Insurance Company, Bank |

| Permitted Activities | Payment collection and disbursement, stored-value funds, fund transfers, cross-border remittance (limited), securities dealing/brokerage/underwriting, lending, deposit-taking (banks only) |

| Restricted Activities | Banking activities without bank license; electronic payment services above thresholds without EPI license |

| Cross-Border Service Allowed | Yes |

| Physical Inspection Required | Yes |