Explore Countries for Living & Doing Business

Find and compare the best jurisdictions for your business

Find and compare the best jurisdictions for your business

Compare with other jurisdictions or get in touch for expert guidance.

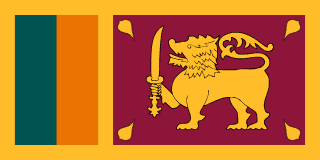

South Asian island with tea exports and tourism

Region

ASIA PACIFIC

Corporate Tax

30%

Setup Time

3 weeks

Currency

LKR

Sri Lanka, an island nation south of India, offers strategic Indian Ocean positioning despite recent economic challenges. The country's company registration framework supports business setup for those with long-term perspectives.

With a population of 22 million, Sri Lanka offers tropical island living with cultural richness. Sinhala and Tamil are official, with English widely used in business. The tropical climate is warm with monsoon seasons.

Healthcare is available through public and private systems. Safety has improved with conflict resolution. The cost of living is very low.

The beaches, hill country, and archaeological heritage create significant tourism appeal.

Corporate tax rates vary by sector, with standard rate around 30%. Personal income tax reaches 36%. VAT applies at 18%.

The Sri Lankan rupee experienced significant devaluation during the 2022 crisis. The economy is recovering from severe challenges. The Board of Investment promotes foreign investment with various incentives.

Company registration through the Registrar of Companies is established. Private limited companies are standard. Foreign ownership is permitted in most sectors.

Company formation takes approximately 1-2 weeks. Minimum capital requirements are minimal. Annual compliance includes filings.

Sri Lanka has not established crypto license frameworks. The Central Bank has issued warnings. Digital asset regulation remains undeveloped.

Gambling is restricted in Sri Lanka. The regulatory environment does not support commercial gambling licensing.

Economic recovery from 2022 crisis continues. Political stability requires ongoing assessment. Infrastructure has improved but varies.

Banking access is available but has faced challenges. Professional services exist in Colombo.

Sri Lanka suits long-term investors, tourism-related operations, and businesses with patient perspectives for their business setup.

Local: Pvt Ltd

Local: PLC

Local: Branch

| Corporate Tax Rate | 30% |

| Personal Income Tax Rate | 36% |

| VAT / Sales Tax | 18% |

| Capital Gains Tax | 10% |

| Withholding Tax | 14% |

| Reduced Corporate Tax Available | Yes |

| Non-Resident Withholding Exempt | No |

| Tax Treaty Network | Yes |

| Banking Access | MEDIUM |

| Financial Privacy | LOW |

| Currency Controls | STRICT |

| Local Bank Account Required | Yes |

| Non-Resident Bank Account Allowed | No |

| Physical Presence for Banking | Yes |

| Banks Restrictive (High Risk) | Yes |

| AML Officer Required | No |

| MLRO Required | No |

| Compliance Officer Required | No |

| Data Protection Officer Required | No |

| Bookkeeping Frequency | Annual |

| Local Bookkeeping Required | Yes |

| Mandatory Audit | No |

No dedicated crypto licensing framework in Sri Lanka. Crypto is unregulated rather than banned. Banks prohibited from processing crypto transactions under Direction No. 03 of 2021 but individual crypto trading is not illegal. AML/CFT registration with FIU planned for 2025-2026 but not yet implemented.

| License Required | Yes |

| Local Director Required | Yes |

| Local AML Director Required | No |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Capital Maintained in Account | No |

| Compliance Program Required | Yes |

| Travel Rule Compliance | N/A for gambling |

| Business Plan Required | Required as part of license application to Director-General of GRA |

| Personnel Required | Directors, senior managers, key management personnel subject to fit and proper assessment |

| Insurance Required | No |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 1 |

| Shareholder/Director Same Person | Yes |

| Registry Public | Yes |

| Registry Access | Through Gambling Regulatory Authority |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | Yes |

| Technical Audit Mandatory | Yes |

| Corporate Income Tax Applicable | Yes |

| Dividend Tax Applicable | Yes |

| Capital Gains Tax Applicable | Yes |

| Territorial Tax Regime | No |

| VAT Applicable | No |

| Regulators | Gambling Regulatory Authority (GRA) - established under Gambling Regulatory Authority Act, No. 17 of 2025 |

| Licensing Fee Details | Licensing fees to be set by regulations. Minimum capital specified by Minister. 18% gross gambling revenue tax applies. Entry fee for Sri Lankan residents: USD 100. |

| Permitted Business Models | B2C Casino, Digital Gambling, Ship-Based Gambling, Junket Operations |

| Permitted Activities | Casinos, digital gambling, gambling on ships in territorial waters |

| Restricted Activities | Lotteries (reserved for Development Lotteries Board and National Lotteries Board), unlicensed gambling, gambling by/employment of persons under 18/21 |

| Cross-Border Service Allowed | No |

| Physical Inspection Required | Yes |

| Player Fund Segregation | Yes |

| B2B/B2C Separate Requirements | Yes |

| License Required | Yes |

| Local Director Required | Yes |

| Local AML Director Required | No |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Required Share Capital | $1,500,000,000 |

| Capital Maintained in Account | Yes |

| Compliance Program Required | Yes |

| Travel Rule Compliance | FATF compliant |

| Business Plan Required | Comprehensive business plan required for Finance Business Act licensing |

| Personnel Required | Qualified directors, management, company secretary |

| Insurance Required | No |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 2 |

| Shareholder/Director Same Person | Yes |

| Registry Public | Yes |

| Registry Access | Central Bank of Sri Lanka - List of Licensed Finance Companies published online |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | Yes |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | Yes |

| Dividend Tax Applicable | Yes |

| Capital Gains Tax Applicable | Yes |

| Territorial Tax Regime | No |

| VAT Applicable | Yes |

| Regulators | Central Bank of Sri Lanka (CBSL) - Department of Supervision of Non-Bank Financial Institutions for finance companies; Payments and Settlements Department for payment services |

| Licensing Fee Details | Application fees and annual supervision fees apply. Licensed Finance Companies must meet minimum capital of LKR 1.5 billion. Payment card and mobile payment operators licensed under Payment Card and Mobile Payment Systems Regulations No. 1 of 2013. |

| Permitted Business Models | Licensed Finance Company (LFC), Specialized Leasing Company (SLC), Payment Card Issuer, Mobile Payment Operator |

| Permitted Activities | Finance leasing, accepting deposits, lending, payment processing, mobile payments, e-money services |

| Restricted Activities | Banking activities without banking license, insurance without insurance license |

| Cross-Border Service Allowed | No |

| Physical Inspection Required | Yes |