Explore Countries for Living & Doing Business

Find and compare the best jurisdictions for your business

Find and compare the best jurisdictions for your business

Compare with other jurisdictions or get in touch for expert guidance.

Territorial taxation system - foreign income tax-free

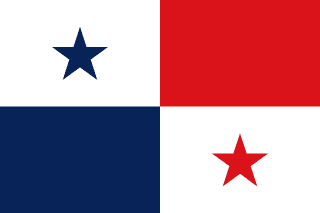

Region

CENTRAL AMERICA

Corporate Tax

25%

Setup Time

2 weeks

Currency

USD

Panama, linking Central and South America and the Atlantic and Pacific, leverages its canal for global logistics significance. The country's efficient company registration and territorial tax system support business setup for international operations.

With a population of 4.4 million, Panama offers tropical living with modern Panama City infrastructure. Spanish is official, with English common in business and Canal Zone. The climate is tropical with distinct rainy season.

Healthcare is good with quality private facilities and medical tourism development. Safety is generally acceptable by regional standards. The cost of living is moderate.

The international character, canal infrastructure, and growing skyline create dynamic environment.

Corporate tax rate stands at 25% on Panama-source income. Territorial taxation means foreign-source income is not taxed. No capital gains tax on foreign assets. Personal income tax reaches 25% on local income.

Panama uses the US dollar as legal tender (alongside balboa at parity). The canal and logistics sector drive significant activity. Banking sector is substantial but has faced international scrutiny.

Company registration through the Public Registry is efficient. The Sociedad Anónima (S.A.) is traditional vehicle, with SRL also common. Foreign ownership is unrestricted.

Company formation takes approximately 1-2 weeks. Minimum capital requirements are flexible. Bearer shares are still technically available but heavily restricted. Annual fees apply.

Panama passed crypto-friendly legislation though comprehensive licensing frameworks continue developing. The regulatory approach has been progressive but implementation details evolve.

The Junta de Control de Juegos regulates gambling. Online gambling licensing exists and Panama has attracted some operators. The framework is established but regulatory sophistication varies.

Banking access has become more challenging due to international compliance pressure. The jurisdiction's privacy reputation has evolved with beneficial ownership requirements. Due diligence on structures is essential.

Professional services are well-developed. Panama's geographic position provides genuine logistics advantages.

Panama suits holding structures, logistics operations, and Americas-focused businesses comfortable with the jurisdiction's positioning for their business setup.

Local: S.A.

Local: Fundación de Interés Privado

Local: Trust

| Corporate Tax Rate | 25% |

| Personal Income Tax Rate | 25% |

| VAT / Sales Tax | 7% |

| Capital Gains Tax | 10% |

| Withholding Tax | 10% |

| Reduced Corporate Tax Available | Yes |

| Non-Resident Withholding Exempt | Yes |

| Tax Treaty Network | Yes |

| Banking Access | MEDIUM |

| Financial Privacy | HIGH |

| Currency Controls | NONE |

| Local Bank Account Required | No |

| Non-Resident Bank Account Allowed | Yes |

| Physical Presence for Banking | Yes |

| Banks Restrictive (High Risk) | Yes |

| AML Officer Required | No |

| MLRO Required | No |

| Compliance Officer Required | No |

| Data Protection Officer Required | No |

| Bookkeeping Frequency | Annual |

| Local Bookkeeping Required | No |

| Mandatory Audit | No |

No dedicated crypto licensing framework in Panama. Cryptocurrency is legal and largely unregulated. Bill 247 proposes VASP licensing but has not been enacted as of January 2026. Panama operates under territorial tax principles with no crypto-specific taxes.

| License Required | Yes |

| Local Director Required | Yes |

| Local AML Director Required | No |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Required Share Capital | $0 |

| Capital Maintained in Account | No |

| Compliance Program Required | Yes |

| Travel Rule Compliance | N/A for gambling |

| Business Plan Required | Detailed business plan including hardware/software specifications, game descriptions, target markets |

| Personnel Required | Minimum 3 directors required for company structure |

| Insurance Required | No |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 3 |

| Shareholder/Director Same Person | Yes |

| Registry Public | No |

| Registry Access | Junta de Control de Juegos (JCJ) maintains license register |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Monthly |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Monthly |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | Yes |

| Technical Audit Mandatory | Yes |

| Corporate Income Tax Applicable | No |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | Yes |

| VAT Applicable | No |

| Regulators | Junta de Control de Juegos (JCJ) |

| Licensing Fee | $40,000 |

| Licensing Fee Details | Initial licensing fee: $40,000 for master license (up to 7 years), annual renewal fee: $20,000, 10% GGR tax on Panama-source gaming revenue |

| Permitted Business Models | B2C online casino, B2B gaming software, Sports betting |

| Permitted Activities | Online casino, sports betting, virtual slots, poker, live dealer games, lottery |

| Restricted Activities | Panama residents cannot participate in licensed online gambling operations |

| Cross-Border Service Allowed | Yes |

| Physical Inspection Required | Yes |

| Player Fund Segregation | Yes |

| B2B/B2C Separate Requirements | Yes |

| License Required | Yes |

| Local Director Required | Yes |

| Local AML Director Required | Yes |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Required Share Capital | $500,000 |

| Capital Maintained in Account | Yes |

| Compliance Program Required | Yes |

| Travel Rule Compliance | FATF compliant |

| Business Plan Required | Comprehensive business plan required |

| Personnel Required | Directors, compliance officer, AML officer |

| Insurance Required | Yes |

| Insurance Details | Professional indemnity insurance required for financial companies |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 3 |

| Shareholder/Director Same Person | Yes |

| Registry Public | Yes |

| Registry Access | Superintendencia de Bancos de Panamá (SBP) at www.superbancos.gob.pa |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | Yes |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | Yes |

| Dividend Tax Applicable | Yes |

| Capital Gains Tax Applicable | Yes |

| Territorial Tax Regime | Yes |

| VAT Applicable | Yes |

| Regulators | Superintendencia de Bancos de Panamá (SBP), Ministry of Commerce and Industries (MICI), Superintendencia del Mercado de Valores (SMV) |

| Licensing Fee | $25,000 |

| Licensing Fee Details | Application fees vary by license type: Financial company (MICI regulated) requires $500,000 capital; Securities/Investment (SMV regulated) requires $350,000 capital; Banking licenses require additional fees and higher capital |

| Permitted Business Models | Financial services company, Money remittance, Investment company, Trust services |

| Permitted Activities | Lending, factoring, leasing, money remittance, investment management, trust services |

| Restricted Activities | Full banking services require separate banking license from SBP; EMI/PI licenses not specifically regulated |

| Cross-Border Service Allowed | Yes |

| Physical Inspection Required | Yes |