Explore Countries for Living & Doing Business

Find and compare the best jurisdictions for your business

Find and compare the best jurisdictions for your business

Compare with other jurisdictions or get in touch for expert guidance.

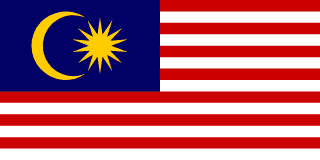

Southeast Asian hub with common law and Islamic finance

Region

ASIA PACIFIC

Corporate Tax

24%

Setup Time

2 weeks

Currency

MYR

Malaysia, a multi-ethnic Southeast Asian nation, offers access to a diversified economy and strategic regional position. The country's improving company registration framework supports business setup for manufacturing, services, and regional operations.

With a population of 34 million, Malaysia offers modern living at moderate costs. Malay is the official language, with English widely used in business. The tropical climate is warm and humid year-round.

Healthcare is good with quality private facilities. Safety is generally acceptable. The cost of living is moderate, significantly lower than Singapore.

The multicultural society blending Malay, Chinese, and Indian influences creates unique character.

Corporate tax rate stands at 24%. Personal income tax reaches 30%. Service tax applies at 6%. Various incentives exist for manufacturing, technology, and Islamic finance.

The Malaysian ringgit is managed by Bank Negara. The economy has diversified from commodities to electronics manufacturing and services. Labuan provides offshore option within Malaysian sovereignty.

Company registration through the Companies Commission (SSM) is digital. Sdn Bhd (private limited company) is the standard vehicle. Foreign ownership is permitted in most sectors, with equity conditions in certain industries.

Company formation takes approximately 1-2 weeks. Minimum capital is RM 1. At least one director must be Malaysian resident. Annual compliance includes filing accounts.

The Securities Commission Malaysia regulates digital asset exchanges through recognized market operator licensing. The framework provides regulatory clarity for established operators.

Gambling is restricted under Islamic law for Muslims. Limited licensing exists for non-Muslim operations. Foreign operators typically find limited opportunity within Malaysian gambling license frameworks.

Racial equity policies affect certain sectors. The domestic market, while substantial, is smaller than Indonesia. Religious and cultural considerations influence business environment.

Banking access is available through Malaysian and international banks. Professional services are well-developed. Malaysia's moderate costs and strategic position provide regional advantages.

Malaysia suits manufacturing, regional operations, and Islamic finance for their business setup.

Local: Sdn Bhd

Local: Bhd

Local: LLP

Local: Branch

| Corporate Tax Rate | 24% |

| Personal Income Tax Rate | 30% |

| VAT / Sales Tax | 8% |

| Capital Gains Tax | 10% |

| Withholding Tax | 0% |

| Reduced Corporate Tax Available | Yes |

| Non-Resident Withholding Exempt | No |

| Tax Treaty Network | Yes |

| Banking Access | HIGH |

| Financial Privacy | MEDIUM |

| Currency Controls | SOME |

| Local Bank Account Required | No |

| Non-Resident Bank Account Allowed | Yes |

| Physical Presence for Banking | Yes |

| Banks Restrictive (High Risk) | No |

| AML Officer Required | No |

| MLRO Required | No |

| Compliance Officer Required | No |

| Data Protection Officer Required | No |

| Bookkeeping Frequency | Annual |

| Local Bookkeeping Required | Yes |

| Mandatory Audit | Yes |

| License Required | Yes |

| Local Director Required | Yes |

| Local AML Director Required | Yes |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Required Share Capital | $5,000,000 |

| Capital Maintained in Account | Yes |

| Compliance Program Required | Yes |

| Travel Rule Compliance | FATF Travel Rule - no de minimis threshold |

| Business Plan Required | Comprehensive business plan, risk management framework, AML/CFT policies required |

| Personnel Required | Fit and proper directors, compliance officer, AML officer, qualified management team |

| Insurance Required | No |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 2 |

| Shareholder/Director Same Person | Yes |

| Registry Public | Yes |

| Registry Access | Securities Commission Malaysia maintains public register of licensed DAX operators |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | Yes |

| Technical Audit Mandatory | Yes |

| Corporate Income Tax Applicable | Yes |

| Dividend Tax Applicable | Yes |

| Capital Gains Tax Applicable | Yes |

| Territorial Tax Regime | No |

| VAT Applicable | Yes |

| Regulators | Securities Commission Malaysia (SC) |

| Licensing Fee | $0 |

| Licensing Fee Details | SC does not publish fixed licensing fees; application fees determined on case-by-case basis. Total setup costs estimated at RM50,000-100,000 including legal and compliance |

| Permitted Business Models | Digital Asset Exchange (DAX), Digital Asset Custodian (DAC), Initial Exchange Offering (IEO) Platform |

| Permitted Activities | Trading of SC-approved digital assets, custody services, IEO platform operation |

| Restricted Activities | Only SC-approved digital assets permitted (Bitcoin, Ethereum, Cardano, Chainlink, LiteCoin, Ripple, Solana, Uniswap, Avalanche, Polygon); privacy coins not explicitly permitted |

| Cross-Border Service Allowed | No |

| Physical Inspection Required | Yes |

| Derivatives Allowed | No |

| RWA Tokenization Allowed | No |

| App Store Listing Allowed | Yes |

| Crypto Custody Allowed | Yes |

| License Required | Yes |

| Local Director Required | Yes |

| Local AML Director Required | Yes |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Capital Maintained in Account | No |

| Compliance Program Required | Yes |

| Travel Rule Compliance | N/A |

| Business Plan Required | Business plan required for license application |

| Personnel Required | Fit and proper directors, local Malaysian directors required |

| Insurance Required | No |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | No |

| Min. Shareholders | 1 |

| Min. Directors | 1 |

| Shareholder/Director Same Person | Yes |

| Registry Public | No |

| Registry Access | Not publicly available |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | Yes |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | Yes |

| Dividend Tax Applicable | Yes |

| Capital Gains Tax Applicable | Yes |

| Territorial Tax Regime | No |

| VAT Applicable | No |

| Regulators | Ministry of Finance Malaysia - Betting Control Unit (Unit Kawalan Perjudian) |

| Licensing Fee Details | Fees determined by Ministry of Finance at discretion; gambling highly restricted in Malaysia with only one land-based casino license (Genting Highlands) and limited lottery operators. Online gambling not licensed. |

| Permitted Business Models | Land-based casino (extremely limited - only one license), lotteries, horse racing |

| Permitted Activities | Licensed lotteries (6 operators), casino gaming (1 operator - Genting), horse racing (3 turf clubs) |

| Restricted Activities | Online gambling not licensed, sports betting prohibited under Betting Act 1953, Muslims prohibited from gambling |

| Cross-Border Service Allowed | No |

| Physical Inspection Required | Yes |

| Player Fund Segregation | Yes |

| B2B/B2C Separate Requirements | No |

| License Required | Yes |

| Local Director Required | Yes |

| Local AML Director Required | Yes |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Required Share Capital | $5,000,000 |

| Capital Maintained in Account | Yes |

| Compliance Program Required | Yes |

| Travel Rule Compliance | FATF compliant |

| Business Plan Required | Comprehensive business plan with 3-year projections required |

| Personnel Required | Fit and proper directors, compliance officer, qualified management team, local resident director |

| Insurance Required | No |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | No |

| Min. Shareholders | 1 |

| Min. Directors | 2 |

| Shareholder/Director Same Person | Yes |

| Registry Public | Yes |

| Registry Access | Bank Negara Malaysia maintains public list of licensed institutions |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | Yes |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | Yes |

| Dividend Tax Applicable | Yes |

| Capital Gains Tax Applicable | Yes |

| Territorial Tax Regime | No |

| VAT Applicable | Yes |

| Regulators | Bank Negara Malaysia (BNM) |

| Licensing Fee | $0 |

| Licensing Fee Details | BNM does not publish fixed fees; EMI license capital requirements: Standard EMI RM1 million or 8% of outstanding e-money liabilities (whichever higher), Eligible EMI RM5 million or 8% of outstanding e-money liabilities (whichever higher). Eligibility requires 500,000+ active users or 5% market share |

| Permitted Business Models | Electronic Money Issuer (EMI), Remittance Service Provider, Money Changing |

| Permitted Activities | E-money issuance, payment services, remittance, money changing |

| Restricted Activities | Banking license requires separate approval with much higher requirements and foreign ownership restrictions |

| Cross-Border Service Allowed | Yes |

| Physical Inspection Required | Yes |