Explore Countries for Living & Doing Business

Find and compare the best jurisdictions for your business

Find and compare the best jurisdictions for your business

Compare with other jurisdictions or get in touch for expert guidance.

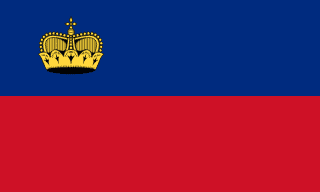

European microstate with strong foundations and trust law

Region

WESTERN EUROPE

Corporate Tax

12.5%

Setup Time

3 weeks

Currency

CHF

Liechtenstein, a tiny principality between Switzerland and Austria, has developed significant financial services specializing in asset structuring and blockchain regulation. The country's company registration framework supports specialized business setup.

With a population of 39,000, Liechtenstein offers exceptional quality of life with Alpine character. German is the official language. The mountainous landscape provides natural beauty and outdoor recreation.

Healthcare is excellent through Swiss-integrated insurance system. Safety is outstanding with minimal crime. The cost of living is very high, among world's highest.

The microstate character means limited urban amenities but high living standards.

Corporate tax rate stands at 12.5%. Personal income tax is moderate by European standards. VAT applies at 8.1% (Swiss rate under customs union). The tax burden is lower than many European neighbors.

Liechtenstein uses the Swiss franc under customs and monetary union with Switzerland. The economy depends on financial services and specialized manufacturing. EEA membership provides EU single market access without EU membership.

Company registration through the Commercial Register is established. The AG (stock corporation), GmbH (limited liability company), and Stiftung (foundation) serve various purposes. Foreign ownership is permitted.

Company formation takes approximately 1-2 weeks with notarial requirements. Minimum capital is CHF 30,000 for GmbH, CHF 50,000 for AG. Annual compliance includes audited financial statements for larger entities.

Liechtenstein passed the "Blockchain Act" (TVTG) providing comprehensive digital asset regulation. The FMA issues crypto licenses for various token-related services. This pioneering framework has attracted blockchain businesses seeking regulatory clarity.

Gambling regulation exists but Liechtenstein has not positioned itself for international online gambling licensing. The small market and conservative approach limit gaming opportunities.

The microstate has limited capacity for large-scale operations. Access is through Switzerland with no airport. The high costs suit high-value, specialized operations.

Banking access is available through Liechtenstein banks. Professional services are sophisticated for asset structuring and blockchain.

Liechtenstein suits foundations and trusts, blockchain companies seeking regulation, and specialized financial structures for their business setup.

Local: GmbH

Local: AG

Local: Stiftung

Local: Trust

| Corporate Tax Rate | 12.5% |

| Personal Income Tax Rate | 22.4% |

| VAT / Sales Tax | 8.1% |

| Capital Gains Tax | 0% |

| Withholding Tax | 0% |

| Reduced Corporate Tax Available | Yes |

| Non-Resident Withholding Exempt | Yes |

| Tax Treaty Network | Yes |

| Banking Access | HIGH |

| Financial Privacy | MEDIUM |

| Currency Controls | NONE |

| Local Bank Account Required | Yes |

| Non-Resident Bank Account Allowed | No |

| Physical Presence for Banking | Yes |

| Banks Restrictive (High Risk) | Yes |

| AML Officer Required | Yes |

| MLRO Required | Yes |

| Compliance Officer Required | No |

| Data Protection Officer Required | No |

| Bookkeeping Frequency | Annual |

| Local Bookkeeping Required | Yes |

| Mandatory Audit | Yes |

| License Required | Yes |

| Local Director Required | Yes |

| Local AML Director Required | Yes |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Required Share Capital | $10,000 |

| Capital Maintained in Account | Yes |

| Compliance Program Required | Yes |

| Travel Rule Compliance | EU Travel Rule / FATF Travel Rule (implemented via Due Diligence Act amendments 2021) |

| Business Plan Required | Comprehensive business plan required including description of intended crypto services, IT structure, organizational structure, and compliance framework |

| Personnel Required | Due Diligence Officer (contact person with FMA), fit and proper management personnel meeting 'Reliability' standards |

| Insurance Required | No |

| Remote Incorporation Possible | Yes |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 1 |

| Shareholder/Director Same Person | Yes |

| Registry Public | Yes |

| Registry Access | FMA maintains public registry of TT Service Providers at https://www.fma-li.li |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | No |

| Technical Audit Mandatory | Yes |

| Corporate Income Tax Applicable | Yes |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | No |

| VAT Applicable | Yes |

| Regulators | Financial Market Authority (FMA Liechtenstein) |

| Licensing Fee | $1,500 |

| Licensing Fee Details | CHF 1,500 standard application fee (non-refundable). CHF 700 for each additional crypto activity. Annual supervisory fee of CHF 500 basic fee plus variable fee based on business model, capped at CHF 100,000 annually. |

| Permitted Business Models | Token Issuer, Token Generator, TT Key Depositary, TT Token Depositary, TT Protector, Physical Validator, TT Exchange Service Provider, TT Verifying Authority, TT Price Service Provider, TT Identity Service Provider, TT Agent |

| Permitted Activities | Token issuance, token generation, custody, exchange services, price services, identity verification, transfer services |

| Restricted Activities | Activities falling under MiCAR scope require separate MiCAR authorization from 1 January 2026 |

| Cross-Border Service Allowed | No |

| Physical Inspection Required | No |

| Derivatives Allowed | Yes |

| RWA Tokenization Allowed | Yes |

| App Store Listing Allowed | Yes |

| Crypto Custody Allowed | Yes |

| License Required | Yes |

| Local Director Required | Yes |

| Local AML Director Required | Yes |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Capital Maintained in Account | No |

| Compliance Program Required | Yes |

| Travel Rule Compliance | N/A |

| Business Plan Required | Detailed business plan, financial statements, company structure documentation, and personnel information required |

| Personnel Required | Background-checked owners, directors, and senior managers with integrity and suitability |

| Insurance Required | No |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 1 |

| Shareholder/Director Same Person | Yes |

| Registry Public | No |

| Registry Access | Office of Economic Affairs maintains licensing records |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | Yes |

| Technical Audit Mandatory | Yes |

| Corporate Income Tax Applicable | Yes |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | No |

| VAT Applicable | No |

| Regulators | Office of Economic Affairs (Amt für Volkswirtschaft) |

| Licensing Fee Details | Land-based casino licenses available. Online gambling license moratorium extended until at least 2028. Licensing fees vary by scope. |

| Permitted Business Models | Land-based casino operations only |

| Permitted Activities | Table games, slot machines (land-based only). Lottery games previously licensed but discontinued. |

| Restricted Activities | Online gambling - moratorium on licensing until at least 2028. Sports betting legal but no licensed operators currently active. |

| Cross-Border Service Allowed | No |

| Physical Inspection Required | Yes |

| Player Fund Segregation | Yes |

| B2B/B2C Separate Requirements | No |

| License Required | Yes |

| Local Director Required | Yes |

| Local AML Director Required | Yes |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Required Share Capital | $350,000 |

| Capital Maintained in Account | Yes |

| Compliance Program Required | Yes |

| Travel Rule Compliance | FATF compliant / EU Transfer of Funds Regulation |

| Business Plan Required | 3-year business plan with marketing plan, budget, own funds information, organizational structure, and description of planned agents/branches/outsourcing arrangements |

| Personnel Required | Minimum 2 directors with financial industry experience (fit and proper), Internal Auditor, Compliance Officer, Risk Management personnel |

| Insurance Required | Yes |

| Insurance Details | Professional indemnity insurance required. Funds safeguarding measures mandatory. |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 2 |

| Shareholder/Director Same Person | Yes |

| Registry Public | Yes |

| Registry Access | FMA register of licensed financial institutions at https://www.fma-li.li |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | Yes |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | Yes |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | No |

| VAT Applicable | Yes |

| Regulators | Financial Market Authority (FMA Liechtenstein) |

| Licensing Fee | $30,000 |

| Licensing Fee Details | EMI license fee CHF 30,000. Payment Institution license varies. Application review typically 3 months. Annual supervisory fees apply based on business volume. |

| Permitted Business Models | Electronic Money Institution (EMI), Payment Institution (PI), Investment Firm, Asset Management Company |

| Permitted Activities | E-money issuance, payment services, money remittance, currency exchange, investment services, portfolio management |

| Restricted Activities | Banking activities require separate banking license with higher capital requirements |

| Cross-Border Service Allowed | Yes |

| Physical Inspection Required | Yes |