Explore Countries for Living & Doing Business

Find and compare the best jurisdictions for your business

Find and compare the best jurisdictions for your business

Compare with other jurisdictions or get in touch for expert guidance.

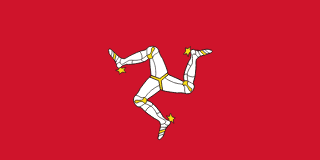

British Crown dependency with 0% corporate tax and strong regulation

Region

WESTERN EUROPE

Corporate Tax

0%

Setup Time

2 weeks

Currency

GBP

The Isle of Man, a self-governing Crown Dependency in the Irish Sea, has developed significant e-gaming and financial services industries. The island's company registration framework and regulatory approach support specialized business setup.

With a population of 85,000, the Isle of Man offers small-island living with British connections. English is the official language. The maritime climate is mild but wet and windy.

Healthcare is provided through the Manx National Health Service. Safety is excellent with minimal crime. The cost of living is moderate. The TT motorcycle races attract global attention but define the island's character for just two weeks annually.

The pace of life suits those valuing community and outdoor activities over urban amenities.

Corporate tax is 0% for most companies, with 10% for regulated financial services and 20% for property income. Personal income tax is capped at 20%. No VAT, capital gains tax, or inheritance tax applies.

The Manx pound is at parity with sterling. The economy depends on financial services, e-gaming, and increasingly space and digital sectors. The Isle of Man Financial Services Authority provides regulation.

Company registration through the Isle of Man Companies Registry is efficient. Various structures serve different purposes. Foreign ownership is unrestricted.

Company formation completes within days. Minimum capital requirements are nominal. Annual compliance includes filing returns.

The Isle of Man has implemented designated business provisions for digital assets. Registration and compliance with AML regulations are required. The jurisdiction has positioned itself as blockchain-friendly.

The Gambling Supervision Commission regulates e-gaming, with one of the world's most established online gambling license regimes dating to 2001. The framework covers full range of remote gaming activities.

The regulatory reputation is strong, attracting premium operators seeking credibility.

Geographic isolation from major markets limits some operations. The small professional services market means fewer options than larger centers. Air connections are limited.

Banking access is available through Isle of Man banks. Professional services are developed for e-gaming and financial services.

The Isle of Man suits online gambling operators, fintech companies, and specialized financial services seeking quality regulation for their business setup.

Local: LLC

Local: Ltd

Local: Foundation

Local: Trust

| Corporate Tax Rate | 0% |

| Personal Income Tax Rate | 21% |

| VAT / Sales Tax | 20% |

| Capital Gains Tax | 0% |

| Withholding Tax | 0% |

| Reduced Corporate Tax Available | No |

| Non-Resident Withholding Exempt | Yes |

| Tax Treaty Network | Yes |

| Banking Access | HIGH |

| Financial Privacy | MEDIUM |

| Currency Controls | NONE |

| Local Bank Account Required | No |

| Non-Resident Bank Account Allowed | Yes |

| Physical Presence for Banking | No |

| Banks Restrictive (High Risk) | No |

| AML Officer Required | No |

| MLRO Required | No |

| Compliance Officer Required | No |

| Data Protection Officer Required | No |

| Bookkeeping Frequency | Annual |

| Local Bookkeeping Required | No |

| Mandatory Audit | No |

| License Required | Yes |

| Local Director Required | Yes |

| Local AML Director Required | No |

| Local Legal Address Required | Yes |

| Local Physical Office Required | No |

| Required Share Capital | $0 |

| Capital Maintained in Account | No |

| Compliance Program Required | Yes |

| Travel Rule Compliance | FATF Travel Rule - implemented October 2024 |

| Business Plan Required | Detailed business plan with description of services, AML/CFT policies required |

| Personnel Required | Minimum 2 Isle of Man resident directors, Nominated Officer (AML), Designated Nominee Officer (DNO) |

| Insurance Required | No |

| Remote Incorporation Possible | Yes |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 1 |

| Shareholder/Director Same Person | Yes |

| Registry Public | Yes |

| Registry Access | IOMFSA Register - https://www.iomfsa.im/register-search/ |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | No |

| Compliance Audit Mandatory | No |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | No |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | No |

| VAT Applicable | Yes |

| Regulators | Isle of Man Financial Services Authority (IOMFSA) |

| Licensing Fee | $2,500 |

| Licensing Fee Details | Registration fee under Designated Businesses (Registration and Oversight) Act 2015 - approximately £2,500 application fee plus annual fees. Class 6 FSA license for security tokens requires separate application |

| Permitted Business Models | Crypto-to-crypto exchange, Crypto-to-fiat exchange, Custody services, Wallet services, Transfer services |

| Permitted Activities | Exchange of virtual assets, Transfer of virtual assets, Safekeeping and administration of virtual assets, Financial services related to virtual asset offerings |

| Restricted Activities | Initial Coin Offerings where coin provides no benefit to purchaser other than the coin itself |

| Cross-Border Service Allowed | Yes |

| Physical Inspection Required | No |

| Derivatives Allowed | No |

| RWA Tokenization Allowed | Yes |

| App Store Listing Allowed | Yes |

| Crypto Custody Allowed | Yes |

| License Required | Yes |

| Local Director Required | Yes |

| Local AML Director Required | Yes |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Required Share Capital | $100,000 |

| Capital Maintained in Account | No |

| Compliance Program Required | Yes |

| Travel Rule Compliance | N/A for gambling |

| Business Plan Required | Comprehensive business plan including 3-year financial projections, game descriptions, AML/CFT policies, responsible gambling measures |

| Personnel Required | Minimum 2 Isle of Man resident directors, Designated Official or Operations Manager resident in Isle of Man, Money Laundering Reporting Officer |

| Insurance Required | No |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 2 |

| Shareholder/Director Same Person | Yes |

| Registry Public | Yes |

| Registry Access | GSC Licensed Operators List |

| Renewal Period | 5 years |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | Yes |

| Technical Audit Mandatory | Yes |

| Corporate Income Tax Applicable | No |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | No |

| VAT Applicable | No |

| Regulators | Gambling Supervision Commission (GSC) |

| Licensing Fee | $5,250 |

| Licensing Fee Details | Application fee: £5,250. Annual fees: Full OGRA License £36,750; Sub-License £10,500; Network Services License £52,500; Software Supplier License £36,750. Gaming duty: 0.1%-1.5% of gross gaming yield based on revenue tiers |

| Permitted Business Models | B2C Full License, B2B Software Supplier, Network Services, Sub-License |

| Permitted Activities | Online casino, Sports betting, Poker, Bingo, Lottery, Pool betting, Pari-mutuel, White label solutions |

| Restricted Activities | Spread betting (regulated by IOMFSA instead) |

| Cross-Border Service Allowed | Yes |

| Physical Inspection Required | Yes |

| Player Fund Segregation | Yes |

| B2B/B2C Separate Requirements | No |

| License Required | Yes |

| Local Director Required | Yes |

| Local AML Director Required | Yes |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Required Share Capital | $125,000 |

| Capital Maintained in Account | Yes |

| Compliance Program Required | Yes |

| Travel Rule Compliance | FATF compliant |

| Business Plan Required | Detailed business plan with 3-year financial projections, compliance framework, risk management procedures |

| Personnel Required | Minimum 2 Isle of Man resident officers for branch operations, qualified directors with relevant experience, Compliance Officer, MLRO |

| Insurance Required | Yes |

| Insurance Details | Professional indemnity insurance may be required depending on license class |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 2 |

| Shareholder/Director Same Person | Yes |

| Registry Public | Yes |

| Registry Access | https://www.iomfsa.im/register-search/ |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | Yes |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | Yes |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | No |

| VAT Applicable | Yes |

| Regulators | Isle of Man Financial Services Authority (IOMFSA) |

| Licensing Fee | $5,000 |

| Licensing Fee Details | Application and annual fees vary by license class. Class 8 Money Transmission Services requires separate application. Banking (Class 1) has highest requirements. Fees typically range from £2,000-£10,000 depending on activity class |

| Permitted Business Models | Deposit taking, Investment business, Money transmission services, Corporate services, Fund administration |

| Permitted Activities | Payment services, Money remittance, E-money issuance (limited), Investment management, Trust and fiduciary services |

| Restricted Activities | Full banking license has strict requirements; e-money issuance requires specific authorization |

| Cross-Border Service Allowed | Yes |

| Physical Inspection Required | Yes |