Explore Countries for Living & Doing Business

Find and compare the best jurisdictions for your business

Find and compare the best jurisdictions for your business

Compare with other jurisdictions or get in touch for expert guidance.

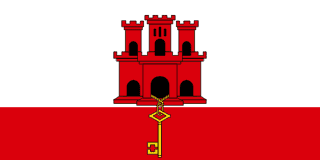

British territory with competitive tax and DLT framework

Region

WESTERN EUROPE

Corporate Tax

15%

Setup Time

2 weeks

Currency

GBP

Gibraltar, a British Overseas Territory at the Mediterranean's entrance, has developed significant financial services and gaming industries. The jurisdiction's company registration framework and regulatory quality support premium business setup for specific sectors.

With a population of 34,000 on 6.7 square kilometers, Gibraltar offers compact living with British character. English is the official language. The Mediterranean climate is pleasant year-round.

Healthcare is provided through the Gibraltar Health Authority with UK-style services. Safety is excellent with very low crime rates. The cost of living is high, with limited housing stock driving prices. Many residents live across the border in Spain.

The tax advantages and small-town character attract financial services professionals.

Corporate tax rate stands at 12.5%. Personal income tax is capped at £28,360 gross tax liability under the HEPSS system for qualifying individuals. No VAT applies (Gibraltar is outside the EU VAT area). The tax efficiency combined with UK legal traditions creates appeal.

The Gibraltar pound is pegged at parity with British sterling. Following Brexit, Gibraltar seeks associate membership arrangements with the EU.

Company registration through Companies House Gibraltar is efficient. UK-style private limited companies are standard. Foreign ownership faces no restrictions.

Company formation takes approximately 1-2 days. Minimum capital is nominal at £1. At least one director is required. Annual compliance includes filing accounts and returns.

The Gibraltar Financial Services Commission operates one of the world's earliest Distributed Ledger Technology (DLT) licensing frameworks. The crypto license regime, established in 2018, provides clear regulatory status for qualifying blockchain businesses.

Gibraltar's early-mover advantage has attracted numerous crypto companies seeking regulated status.

The Gibraltar Gambling Commission regulates remote gambling with licensing since 1998. Gibraltar is one of the most established online gambling license jurisdictions globally, hosting major operators.

The regulatory reputation is strong, providing credibility for licensed operators in international markets.

Brexit has created uncertainty regarding EU market access and border fluidity with Spain. The limited physical space constrains operations requiring substantial premises. Residential options are expensive and limited.

Banking access is available but the small market means fewer options than major centers. Professional services are well-developed for financial services and gaming sectors.

Gibraltar suits online gambling operators, crypto companies seeking regulation, and financial services businesses valuing British law for their business setup.

Local: Ltd

Local: PLC

Local: Trust

| Corporate Tax Rate | 15% |

| Personal Income Tax Rate | 39% |

| VAT / Sales Tax | 0% |

| Capital Gains Tax | 0% |

| Withholding Tax | 0% |

| Reduced Corporate Tax Available | No |

| Non-Resident Withholding Exempt | Yes |

| Tax Treaty Network | Yes |

| Banking Access | HIGH |

| Financial Privacy | LOW |

| Currency Controls | NONE |

| Local Bank Account Required | No |

| Non-Resident Bank Account Allowed | Yes |

| Physical Presence for Banking | No |

| Banks Restrictive (High Risk) | No |

| AML Officer Required | No |

| MLRO Required | No |

| Compliance Officer Required | No |

| Data Protection Officer Required | No |

| Bookkeeping Frequency | Annual |

| Local Bookkeeping Required | No |

| Mandatory Audit | No |

| License Required | Yes |

| Local Director Required | Yes |

| Local AML Director Required | Yes |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Required Share Capital | $0 |

| Capital Maintained in Account | No |

| Compliance Program Required | Yes |

| Travel Rule Compliance | FATF Travel Rule implemented since 2021, €1,000 threshold |

| Business Plan Required | Comprehensive business plan required covering technology, governance, cybersecurity, and risk management |

| Personnel Required | Directors with relevant experience, MLRO, qualified compliance staff |

| Insurance Required | Yes |

| Insurance Details | Professional indemnity insurance required where appropriate |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 1 |

| Shareholder/Director Same Person | Yes |

| Registry Public | Yes |

| Registry Access | GFSC maintains public register of authorized DLT providers |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | No |

| Compliance Audit Mandatory | No |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | Yes |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | Yes |

| VAT Applicable | No |

| Regulators | Gibraltar Financial Services Commission (GFSC) |

| Licensing Fee | $10,000 |

| Licensing Fee Details | Application fee varies by category (£10,000-£30,000). Annual fees: Base £11,330 plus 0.1% of trading volume (max £60,000). AML supervision fee £3,000. Category 1 (blockchain projects): £10,000/year. Category 2 (ICO projects): £20,000/year. Category 3 (exchanges): £30,000/year. |

| Permitted Business Models | Crypto exchanges, custody services, wallet providers, OTC trading, token issuance, lending platforms |

| Permitted Activities | Trading, custody, transmission of value using DLT, VASP registration for token sales and exchanges |

| Cross-Border Service Allowed | Yes |

| Physical Inspection Required | No |

| Derivatives Allowed | Yes |

| RWA Tokenization Allowed | Yes |

| App Store Listing Allowed | Yes |

| Crypto Custody Allowed | Yes |

| License Required | Yes |

| Local Director Required | Yes |

| Local AML Director Required | Yes |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Required Share Capital | $10,000 |

| Capital Maintained in Account | No |

| Compliance Program Required | Yes |

| Travel Rule Compliance | N/A for gambling |

| Business Plan Required | Detailed business plan with clear source of funding, proven track record in gambling industry preferred |

| Personnel Required | Experienced management team, MLRO, responsible gambling officer |

| Insurance Required | No |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 1 |

| Shareholder/Director Same Person | Yes |

| Registry Public | Yes |

| Registry Access | Licensed operators published on Gibraltar Government website |

| Renewal Period | Five years |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | Yes |

| Technical Audit Mandatory | Yes |

| Corporate Income Tax Applicable | Yes |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | Yes |

| VAT Applicable | No |

| Regulators | Gibraltar Licensing Authority and Gambling Commissioner |

| Licensing Fee | $100,000 |

| Licensing Fee Details | B2C Remote Gaming/Betting: £100,000 for 5-year license. B2B Support Services: £85,000. New tiered system from 2025: B2C with GGY >£300m: £200,000/year; £20m-£300m: £100,000/year; <£20m: £50,000/year. Gaming duty: 0.15% on gross profit (first £100,000), capped at £425,000/year, minimum £85,000/year. |

| Permitted Business Models | B2C online casinos, sports betting, betting intermediaries; B2B software providers, platform operators |

| Permitted Activities | Remote gaming, remote betting, betting intermediary services, gaming software development |

| Restricted Activities | Marketing license now required under new Gambling Act 2025 for standalone marketing companies |

| Cross-Border Service Allowed | Yes |

| Physical Inspection Required | No |

| Player Fund Segregation | Yes |

| B2B/B2C Separate Requirements | Yes |

| License Required | Yes |

| Local Director Required | Yes |

| Local AML Director Required | Yes |

| Local Legal Address Required | Yes |

| Local Physical Office Required | Yes |

| Required Share Capital | $350,000 |

| Capital Maintained in Account | Yes |

| Compliance Program Required | Yes |

| Travel Rule Compliance | FATF compliant |

| Business Plan Required | Comprehensive 3-5 year business plan with financial projections, risk assessment, governance structure |

| Personnel Required | Experienced directors, MLRO, compliance officer, operational management |

| Insurance Required | Yes |

| Insurance Details | Professional indemnity insurance or guarantee required |

| Remote Incorporation Possible | No |

| 100% Foreign Ownership | Yes |

| Min. Shareholders | 1 |

| Min. Directors | 2 |

| Shareholder/Director Same Person | Yes |

| Registry Public | Yes |

| Registry Access | GFSC maintains public register of authorized financial institutions |

| Renewal Period | Annual |

| Accounting Filing Required | Yes |

| Accounting Filing Frequency | Annual |

| Financial Statement Required | Yes |

| Financial Statement Frequency | Annual |

| Accounting Audit Mandatory | Yes |

| Compliance Audit Mandatory | Yes |

| Technical Audit Mandatory | No |

| Corporate Income Tax Applicable | Yes |

| Dividend Tax Applicable | No |

| Capital Gains Tax Applicable | No |

| Territorial Tax Regime | Yes |

| VAT Applicable | No |

| Regulators | Gibraltar Financial Services Commission (GFSC) |

| Licensing Fee | $5,000 |

| Licensing Fee Details | Application fees vary by license type. EMI: €350,000 minimum capital (GFSC recommends 20% above EU minimum). Annual supervision fees apply. E-money AML fee: £3,000/year. Payment Institution capital: varies by class (€20,000-€125,000). Note: Gibraltar EMIs cannot passport to EU/EEA post-Brexit. |

| Permitted Business Models | E-money institutions, payment institutions, investment firms, insurance companies |

| Permitted Activities | E-money issuance and redemption, payment services, investment services |

| Restricted Activities | Banking services require separate credit institution license |

| Cross-Border Service Allowed | No |

| Physical Inspection Required | Yes |